Never Buy These 5 “Luxury” Items—They’re Losing Value Fast!

Hey investors,

Not all products can be a form of an investment, but luxury products stand out due to its heritage and exclusivity, making it more desirable to own. But exploring such investment options in the field of luxury goods can often be…. a bit rigorous.

It is challenging find pieces that don’t only hold a good price in the present but also maintain stable increase in its value for the future. And with the future being as unpredictable as possible, our investments can’t afford to follow the same account.

“Price is what you pay. Value is what you get.” ~ Warren Buffett

When shopping for luxury goods, buyers are often influenced by current trends, which can result in poor purchasing decisions or impulsive shopping behaviours. Thus, making the buyer’s luxury purchase a bad investment choice if that was their intention of purchasing the product.

And this choice can be anything ranging from high-end tech gadgets and luxurious cars to a tiny, branded wallet. Yes, all luxury items hold an exclusive aura to it, but can it truly hold its value beyond time too. Not all that glitters is gold, the same way not all luxury can say luxury forever, not all of it is infinite, timeless in its glory.

Hence, for an investment in luxury, first knowing what to not buy is important. So, here’s my take on luxury products that are not worth the investment, unless its and indulgence for yourself or just a pretty gift. Let’s dive in:

- High-End Tech Gadgets: Technology is changing at a dynamic rate every day and yes having the latest technology in the palm of your hand feels great, but it doesn’t hold any investment value. These devices depreciate rapidly, as newer models frequently hit the market, leaving older versions outdated and hard to resell at a decent price.Now don’t get me wrong, there is a huge market for olden technology that is old radios, watches, radios, etc, but they have their value due to the nostalgia connected to them and of course their quality. But do high-end tech gadgets hold the same value? Well, it doesn’t seem possible for quite a few years to come honestly.

Let’s not forget that high-end tech products have short product lifecycles due to consumers always wanting the latest technology, their cutting-edge features become obsolete in no time, and many users often end up overpaying for functions they rarely use.

Additionally, luxury tech often demands specialized maintenance and repairs, which can add to its overall cost but not to its overall value over a period, making it a poor investment choice.

- Jewellery from Big Brands: Branded jewellery isn’t just jewellery, it upholds the name of the brand as well. Hence when it is purchased, the buyer not only pays for the jewellery, but also for the brand name, marketing and exclusivity.This also means that the buyer may be paying more for the brand name than the intrinsic value of products itself. Brands are also often huge caterers to the upcoming trend cycles, which results in trendy products that cannot present the essence of timelessness in them which also adds to the growing depreciation of the jewellery.

Let’s also consider the maintenance cost of these items, that often requires specialized care and maintenance, adding to the overall expense. This can make it less practical as an investment compared to other assets. And to decrease its value more, the resale market for luxury jewellery, unlike investment-grade jewellery or precious metals, is rather niche.

This is due to buyers being more interested in the material value of the product rather than the brand, making it harder to sell the products at its original cost let alone demand for something more. I’d suggest looking for jewellery that has historic significance or vintage designs or that which have high-material value, as a good jewellery investment choice.

- Limited-Edition Items: I understand that this may seem like a hot take but stick with me here. Limited edition items in general get an addition to their exquisite aura from the exclusiveness that comes from having possession of that item, whether that item is from Dior, Hermes, Louis Vuitton or any luxury brand.The perception of it being limited changes the view and demand of the item. Therefore, having an item that may be only one of its kind is like having a gold mine for collectors. But if the item consists of parts that are not readily available by the brand, for example, a luxury limited edition car, once it is damaged or some part is broken and not replaceable loses its retail value in the market.

And if that wasn’t enough, even any usage of the item can cause depreciation in its value. Therefore, unless it’s presented in its mint condition, a second-hand buyer will likely not want to purchase it at the original retail price, let alone agree to the owner’s proposed increment in the retail price.

Even though it’s a limited edition, if the quality of the product is not satisfactory, its value decreases significantly. So, unless it’s going to be show piece around your house that is wrapped in a protective layer, it is not a stable investment choice.

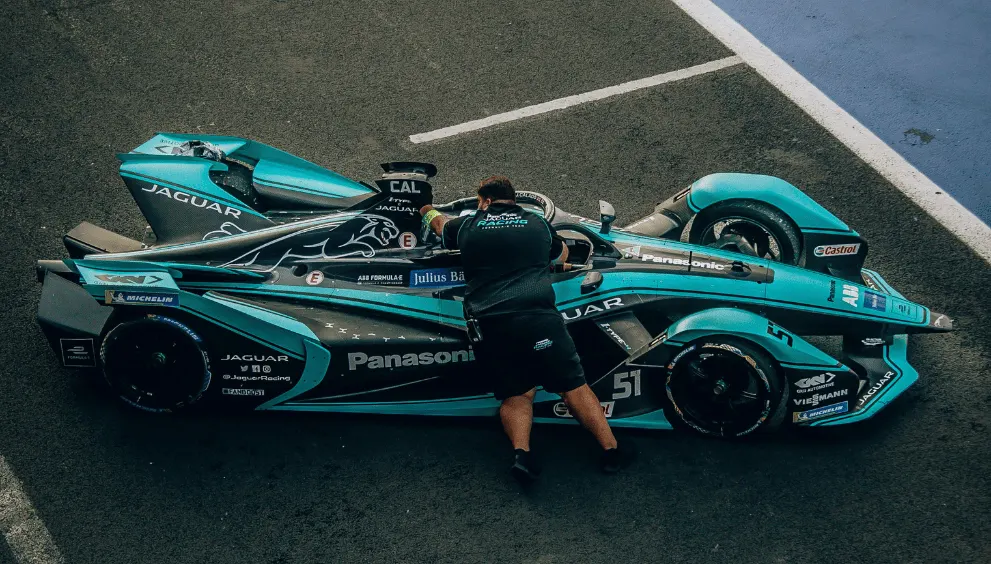

- Luxury Cars: Luxury cars, a very dominant loud symbol of sophistication, exclusivity and class and an especially considered a luxury item for men. But they are also notorious depreciating luxury assets. As soon as the drives off, its value decreases by 10% to 20% by the end of the first year alone.The value drastically decreases after the 5-year mark, as they lose more than half the value of the original price.High initial costs mean a larger absolute loss in value compared to standard cars. And let’s not forget the additional taxes of a luxury product that add to the depreciation of the car, it could also mean your potentially losing a lot of money on a luxury car that was meant to be an investment.

Additionally, luxury cars often come with expensive maintenance and repair needs, which can deter potential buyers in the resale market. The constant release of newer models with upgraded features also makes older versions less desirable. That doesn’t mean that some of the older luxury models like the Lexus LS400, Mercedes-Benz SL-Class (R107), Rolls-Royce Silver Shadow, Cadillac Eldorado, etc. are not in demand, but their perception is different for the buyer compared to the new luxury models. Thus, making them a depreciating asset to the owner unless it is maintained and is viewed as an indulgence.

- Designer Handbags (Trending Ones): Hear me out on this one too. I understand that some designer bags like the Hermes Birkin and Kelly Bags, Chanel’s Timeless Flap Bag or the Louis Vuitton Never full Tote are assets that increase in value, especially if we take the Birkin into consideration that increased form a retail prices range from $9,000 to $150,000 to resale prices up to $223,000 depending on its quality.But unlike these bags that hold timeless heritage, trendy bags often don’t possess that quality due to it being ‘in style’ right now.They are also harmed due to rapidly changing fashion trends, significant markups for branding and marketing, oversaturation in the luxury market, and the inevitable wear and tear from regular use.

Additionally, economic fluctuations can impact buyers’ willingness to spend on non-essential luxury items, further diminishing their resale value. Hence a trendy bag wouldn’t be a suitable investment option, rather a classic bag in good quality will hold its value for a longer period. For my conclusions, dear investors, I would suggest investing in luxury items that stay luxury for infinite rather than just this fashion season.

Hope that helped and remember that luxury is for indulgence and not just an investment. Until next time, Signing off for now.