Jul

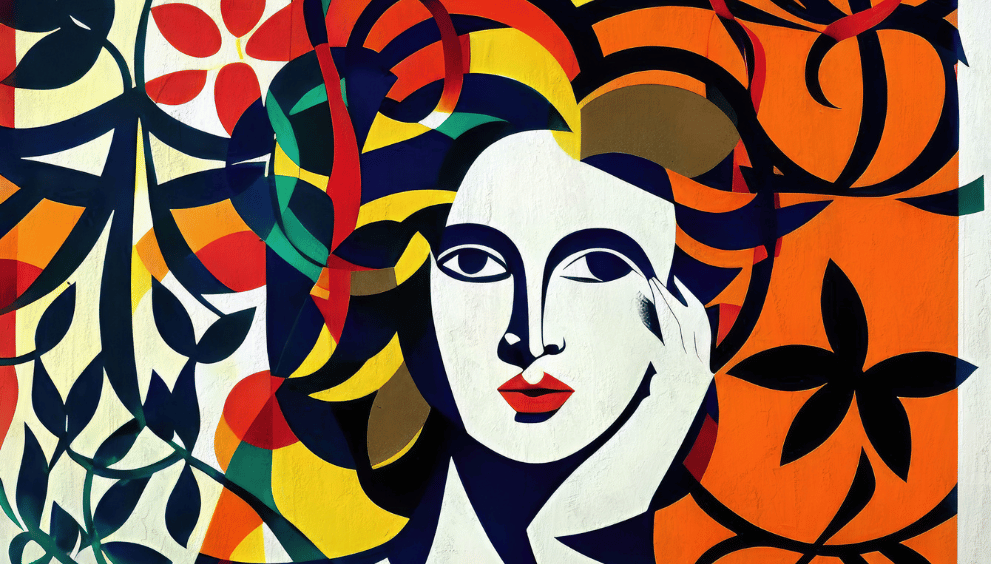

The Trophy Effect: Why Certain Artworks Will Always Be on Billionaire Wishlists

-

Anshuman / 7 months

- July 11, 2025

- 0

- 9 min read

Hello art enthusiasts and investors,

“Art washes away from the soul the dust of everyday life.” – Pablo Picasso.

Beautifully put by Picasso, art has always been a medium of expression, long before we even used speech for that matter. Art has always been more than just beautiful; it has always been more than a little paint on a canvas. You know, it’s more complicated than we can ever imagine, like the depths of our minds.

While art is everything chaos and pretty, it also represents many other things like taste, culture, historical era, and in today’s world, MONEY.

The buying and selling of art isn’t something new to the world. It’s been around since the Italian Renaissance, when art dealers like Giovanni Battista della Palla sold pieces of great artists to the French Royalty. Through the years, the concept of the art market has evolved into a global market for wealth preservation and generation. A market that might as well be more secure than stocks or bonds these days.

While there’s ongoing debate in the art world about billionaire collectors viewing art as mere assets, that discussion can wait. What truly matters is that these same billionaires are the driving force behind patronage, elevating art to the global stage and ensuring its continued influence.

I mean, the Medici Family is the biggest benefactor of the art that is sold in millions today.

For the world’s richest, they saw beyond art and saw a statement, a legacy, an extremely expensive trophy. For them, it’s not just the aesthetic appeal that’s important; it’s the cultural significance, historical reference, the artist, and occasionally social bragging rights.

But why are some pieces so… expensive? How do they stay culturally relevant even after many years? Why do pieces by certain artists like Picasso or Da Vinci from history, or Koons, Warhol of modern contemporary art, and certain other significant artists matter more than others? What gave them the power to initiate bidding wars for every single piece that they ever worked on?

Why are certain artworks always on the billionaire’s list? And which artworks are on it?

Let’s find out!

The Trophy Effect: The Allure of the Most Wanted Piece?

The trophy effect is a psychological effect that, in general, is a tendency of individuals to value objects that they win through effort or if it’s something yearned for by the world. The art market is the perfect example of this. Not only are good quality art pieces a rarity, but they also may not be authentic or lack the right paperwork.

So if a piece were to fit the right criteria in the market, the demand for its possession is unimaginable. These pieces go from being art to being a cultural status symbol.

And in this scarce market, Billionaires don’t look for art just as a source of beauty or appreciation, no, it’s more than that, it’s about possession. Possession of a piece that is yearned for and wanted by the whole world, and that too, not just in the present, but for the future too.

Along with that, the most coveted artworks carry undeniable prestige, a history, and an artist who contributes to both the piece and the owner’s status. These days, it’s not just about a work of art; it’s about all the different things that people connect it to.

Consider Francis Bacon’s 1969 work, Three Studies of Lucian Freud. Once regarded as a chaotic, unsettling mess, the triptych depicting Freud sitting on a wooden chair in a cage-like structure was sold separately at an auction in 1970.

Later in 2013, the paintings were reunited and sold at an auction for $142.4 million at Christie’s New York and sold to Elaine Wynn.

Artist names act as brand names?

Just like the Luxury world, the art world carries names of individuals who were the pioneers of their decades. Monet and Picasso are like Dior and Chanel of the art world. These artists didn’t just leave their life’s world; they left a heritage from their world that we have come to worship. Their works have left an indelible impact on the world.

These artists aren’t just artists, they are brand names, ones that carry prestige and exclusivity in their very being. Their track record in high auction prices, museum retrospectives, and cultural impact only adds to their value. Making these paintings not just desirable but also investable, with high returns.

A good example would be Jean-Michel Basquiat, a favourite among billionaire collectors for his graffiti-style art that more often than not fetches at least 100 million and upwards. His work presents a rebellious, raw spirit of the 1980s that definitely connects to art collectors today.

His most expensive artwork, Untitled (1982), was auctioned in 2017 for $110 million—but it would likely fetch an even higher price in today’s resale market, given Basquiat’s enduring influence.

Less gives more, at least in the art world.

The scarcity of high-quality art and the limited supply in the market naturally drive up its value – a basic economic principle. But in the art world, this phenomenon operates on an entirely different level.

Say, for example, if an artist were to only paint a particular number of paintings in his life, and he sold most of them to royalties or government representations, they eventually fall into the public’s hands. But if the same art were to fall into private hands, the resale value of that product increases tenfold.

The scarcity of pieces by artists like Van Gogh, Rothko, or Warhol is highly sought after due to the finite number of pieces a billionaire can add to their collection. So you can only imagine when a rare masterpiece hits the market, money flows like water cause this may never happen again.

This fuels competitive bidding, one of the key components for the price and acquisition of a piece. It’s not just about acquiring a piece, it’s about winning it.

The Lost Artworks: A well-kept secret

Lost artworks are not only rare, given how difficult it is to steal from an art museum, but they also carry an aura of mystique and unmatched value. If even one of them were ever to reappear, whether at an auction house or on the black market, the world would be scrambling to claim it.

There’s a reason it was lost in the first place – because of its immense worth. And if that same painting were to resurface decades later, giving billionaires a chance to own it, well, in those auction houses, money flows like rivers.

If we take this art piece that Christie’s New York sold in 2017, which was one of their most expensive artwork sold in the house, Da Vinci’s Salvator Mundi, at a whopping $450 million, was also a piece that was considered worthless. That was once considered lost; it unveiled itself in the market in 2005, was restored, and thereafter sold.

So, of course, when it was revealed that the piece was the last known Da Vinci in private hands, the bidding at the auction didn’t hold back. Owning it meant owning a time in history no one would be able to get their hands on, ever.

Art works as Social Propaganda: Using the Medici family techniques

If you’ve ever read about the Medici Family, you know that they were one of the main pillars of the Renaissance. Beyond that, they present a case where they gained their social standing, even after they were looked down by the Royals and Nobles, not just with the cash in their banks. But due to the art and culture that they nurtured with that money.

Those same antiques are still relevant today, as owning an art piece is more than just an investment or personal enjoyment; it’s about social standing. It’s a way of displaying class and structure through your refined taste, in an astounding form.

I mean, have you ever seen an art collector who isn’t ready to turn their house into a mini art gallery, at the drop of a hat? The showcases, private galleries, loaned museums, and exclusive gatherings are just an excuse to flaunt their collection more often than not.

Art is seen as a signal of taste, intellect, culture, upbringing, and mostly access to the world of exclusivity. So if Elon Musk were to purchase an art piece, well, that’s gonna take the world by storm with the proclamation of his taste.

The Hunt for the Next Trophy has already begun.

Classic artists will continue to dominate billionaires’ wishlists with their cultural background and social standing. As the world evolves, more contemporary artists like Banksy, Yayoi Kusama, and Beeple are entering the race as rookies who play like McQueen, commanding millions at auction houses already.

Similarly, new forms of art, particularly digital art and NFTs (Non-Fungible Tokens, a unique digital asset), are introduced as the new “IT” thing in the market. Don’t be surprised if owning one of those eventually becomes similar to owning tangible art pieces from history.

Some good examples of this are “The Merge” by Pak, an NFT, auctioned for $91.8 million in December 2021. Making it the most expensive one ever sold. Or the “Everydays: The First 5000 Days” by Beeple, which was also sold in 2021 for $69.3 million, marking historic moments in the digital art world.

Whether it’s the Trophy Effect or Cultural Significance, certain artworks will always be in demand; it’s like a law of nature. Whether a rare Picasso hits the market, Da Vinci re-surfaces from the shadows, or a culturally significant Basquiat finds itself at auction houses, or even if newer arts like digital art hit the digital shelves. Billionaires will always be on the watch to possess the next big thing or the last decade’s masterpieces.

In the end, owning a trophy artwork is more than just a shining status or a safe investment choice; it’s about cementing that status, making one’s place in history, displaying power, and mostly showing the world how money talks, but art translates it into history. And it’s very rewarding to have something one of a kind, the ultimate flex for billionaires.

Until next time, signing off for now.