The Art of Investment: Why Art Collecting is the Ultimate Long-Term Wealth Strategy

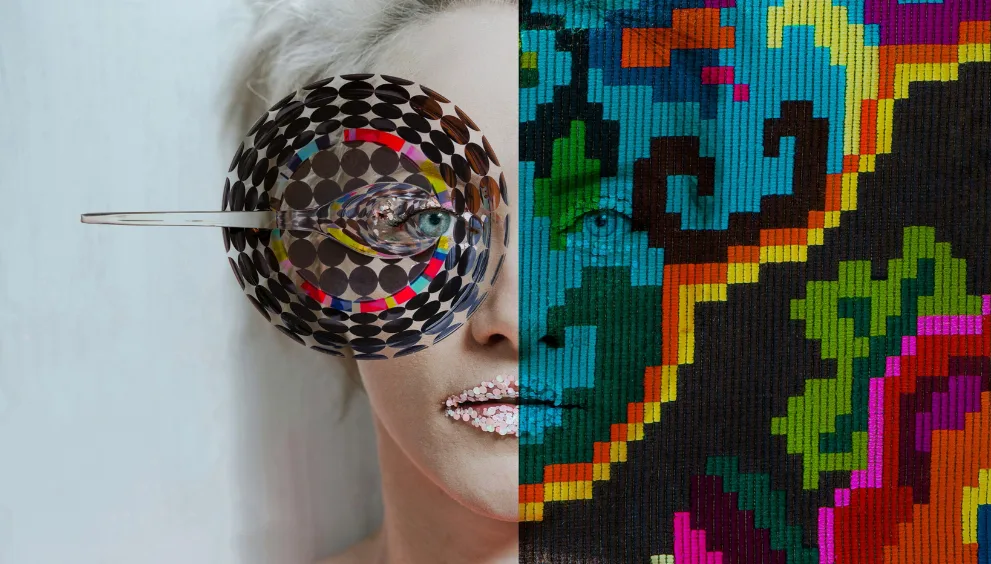

When we think of wealth accumulation, our minds go directly to stocks, bonds, real estate, or mutual funds. But there’s one overlooked and a curious contemporary path that’s making waves and filling portfolios: Art investment. Yes, buying art has traditionally been the pastime of the wealthy, but in modern times, it’s been overhauled. Come in NFTs (Non-Fungible Tokens), the shiny new face of art collection making millionaires and rewriting long-term wealth planning.

Let’s rewind a bit. Traditionally, art collecting required a trained eye, deep pockets, and an in with galleries or auction houses. However, nowadays with NFTs, the same prestige has become digital and democratized. A 20-something digital artist from Indonesia can now sell their work to a collector in New York with the click of a button.

The NFT boom, which exploded in 2021, showed the world that digital art isn’t just legitimate, it’s wildly profitable. Just ask Beeple. In March of 2021, a digital artist sold an NFT painting (Everydays: The First 5000 Days) for a staggering $69 million through Christie’s. This is about the headlines but also is a call to arms. Suddenly, it was not about who owned a Picasso, it was about who got the right JPEG on the blockchain.

And it’s not just painters cashing in. Celebrities and tech billionaires are building NFT collections like they’re the new era of connoisseur wines. Snoop Dogg, in his persona as “Cozomo de’ Medici,” boasts one of the world’s most valued NFT collections. Paris Hilton has collaborated to create and sold her own NFTs and invested heavily as well.

Even billionaire entrepreneur and Shark Tank investor Mark Cuban sees NFTs as more than a fad, they’re the future of owning things digitally. So why is NFT art collecting such a compelling wealth strategy? To begin with, scarcity. NFTs are stored on blockchain technology, they are verifiable, limited, and one of a kind.

Just like a rare painting an NFT of digital art can appreciate like crazy, especially when the artist is popular or the collection is iconic. Second, accessibility. Previously, art investment was out of reach for the masses. Now, anyone with a crypto account and access to the internet can search on platforms such as OpenSea, Rarible, or Foundation, and begin to create a digital gallery.

There’s $100 or $100,000 to spend, you decide. And although not all NFTs are going to be golden geese, many of the original holders of projects such as Bored Ape Yacht Club or Crypto Punks have already made multiples on their investment compared to the stock market. Third, the community. Purchasing NFTs isn’t merely an economic action, it’s cultural.

Numerous projects include benefits such as special events, virtual clubs, or future releases, which make ownership part of a larger experience. Consider it as bringing together investment, identity, and social status. Of course, like any investment, there’s risk. The NFT market is unstable, and trends change quickly.

But that’s also what comes with the territory. Just like early art buyers took risks on unknown artists who went on to become legends, today’s NFT consumers are making informed bets on who will be tomorrow’s digital Warhol.

The most important aspect to successful art investment is within the NFT market, and that is research. Learn about the artist’s history, roadmap for the project, community strength, and the way the artwork speaks to contemporary culture. When you don’t know where to begin, subscribe to platforms that showcase good quality work, or tap into social networks such as Discord and Twitter where collectors and artists converge.

And although the NFT frenzy has cooled a bit since its 2021 high, that’s precisely what’s great news for savvy investors. It indicates the market is stabilizing. The flash-in-the-pan projects are dying off, and more considered, art-led pieces are coming into the foreground. At the end of the day, art investment especially through NFTs is about more than just money.

It’s about supporting creativity, participating in a cultural movement, and owning a piece of history. You are not just buying a file, you are buying ownership stakes in the future of art. So if you need a wealth strategy that is sacred and a little contrarian, don’t go to Wall Street. Look to the blockchain. And besides, in a world where attention is money and creativity shapes culture, investing in art, particularly digital could be the best thing you ever do.